Non-QM and DSCR Loans are Available!

Receive a quote on a Non-QM and DSCR Loans today.

What is a non-QM loan?

Do I Qualify?

At Iris Mortgage, we believe everyone should have access to home financing that fits their story — not just the conventional one. That’s why we want to introduce you to the concept of a non-qualified mortgage (non-QM) loan — what it is, when it makes sense, and how it might serve Michigan buyers (and realtors) whose profiles don’t align perfectly with traditional mortgage guidelines.

Bank Statement Loans

Bank Statement loans are designed for self-employed borrowers or business owners whose tax returns don’t reflect their true income. Instead of relying on W-2s or pay stubs, lenders use 12–24 months of personal or business bank statements to calculate average monthly deposits and determine qualifying income. This approach helps entrepreneurs, freelancers, and gig-economy workers who may have legitimate write-offs or irregular cash flow still qualify for a mortgage. At Iris Mortgage, we work with flexible Non-QM programs that make it easier for Michigan borrowers with strong bank activity—but unconventional income—to achieve homeownership or refinance on their terms.

Why? as a self employed business owner Tax returns after writeoffs do not always allow you to qualify for normal FNMA or FHLMC mortgages. A bank statement loan will not require tax returns

Who? self employed business owners

How? Income calculation involves use of 12 or 24 months of business or personal bank statements, whichever will give greater income. No need for tax returns.

Best for primary homes, second homes, and investment properties for non traditional income earners.

DSCR Loans (Debt Service Coverage Ratio)

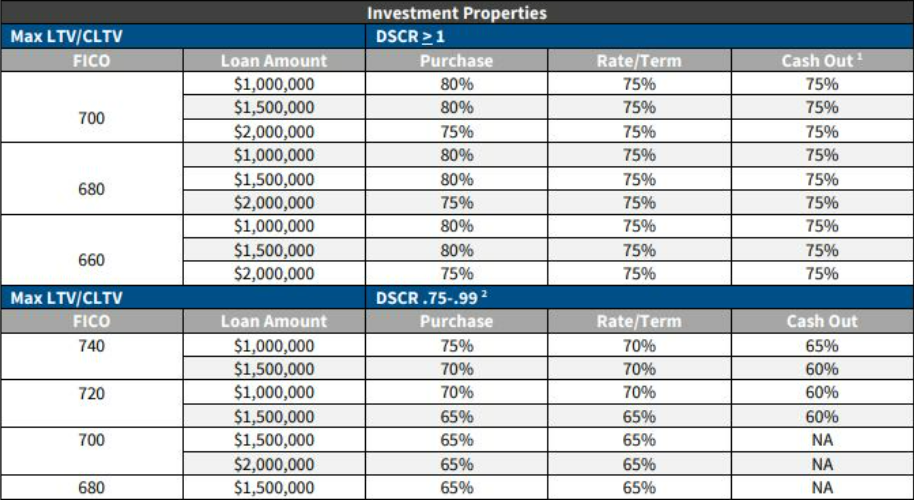

DSCR Loans (Debt Service Coverage Ratio loans) are built for real estate investors who want to qualify based on property income, not personal income. Lenders use the property’s rental income divided by its housing expenses (principal, interest, taxes, and insurance) to determine whether it can support the loan—typically aiming for a DSCR of 1.0 or higher. This makes DSCR loans ideal for investors expanding rental portfolios or buying through LLCs without needing full tax documentation. At Iris Mortgage, we help Michigan investors leverage DSCR financing to grow cash-flowing properties quickly and efficiently, without traditional income hurdles.

Why? Coupled with our appraisal panel this is a non doc loan that will allow you to buy a property with % down and no income documents. This includes first time investors with strong contributing factors. If you want to park your money in real estate and own an asset that can grow DSCR seasoned and first time investor option is a great idea! This loan operates without the need for tax returns.

Who? first time self employed investors. Seasoned investors. People who wouldn't qualify traditionally through FNMA or FHLMC guidelines for a forward investment property mortgage.

How? Qualify based on proposed mortgage payment being the same or lower of the rental lease agreement or rental amount from appraisal form 1007. No need for tax returns.

Best for investment properties.

Other Non-QM Loan Types

P&L Only, 1099 Only, WVOE Only, and Asset Utilization programs are specialized Non-QM loan options designed to help borrowers with unique income situations qualify for a mortgage. A P&L Only loan uses a profit-and-loss statement prepared by a CPA to verify income—ideal for self-employed borrowers whose business expenses reduce their taxable income. A 1099 Only loan is for independent contractors who receive 1099 forms instead of W-2s, allowing qualification based on gross income shown on those forms. A WVOE Only loan relies solely on a written verification of employment from an employer rather than full tax documentation—perfect for borrowers with limited paperwork but consistent pay history. Finally, Asset Utilization loans qualify borrowers based on their liquid assets, such as bank, investment, or retirement accounts, by converting a portion of those assets into “income” for qualifying purposes. At Iris Mortgage, we help Michigan homebuyers and investors use these flexible documentation options to achieve financing when traditional guidelines don’t fit.